Renewable Term Life Insurance

During the stated period the policyholder will be. Renewable term life insurance allows the policyholder to continue coverage after the original term has expired without further evidence of insurability.

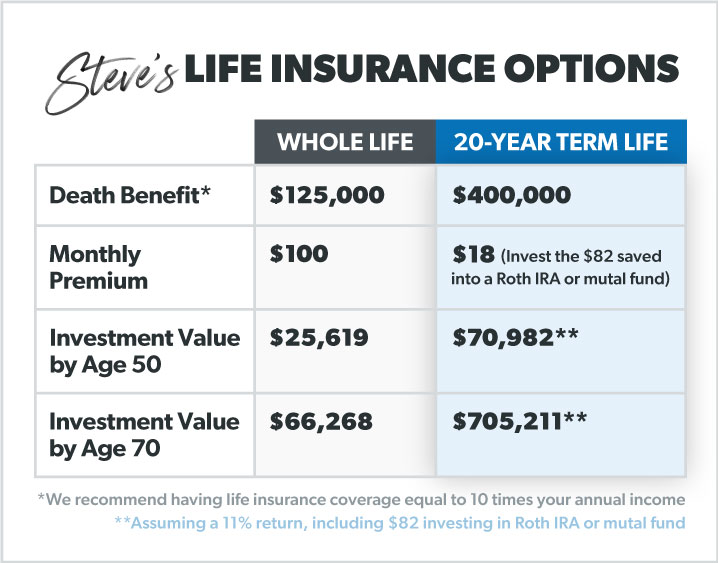

Why 90 Of Experts Say Term Life Insurance Is Best Suze Orman Too

Why 90 Of Experts Say Term Life Insurance Is Best Suze Orman Too

This annual term allows you to lock in up to 12 months where you can then renew without having to reapply or take a medical exam.

Renewable term life insurance. The majority of term life policies are indeed renewable. Renewable term life insurance can be a provision in a life insurance. Renewable term life insurance overview.

For instance if an individual has a term life insurance policy that is scheduled to mature in 2020 heshe is given the ability to renew the policy at that time instead. With renewable term coverage can be extended even if the. What it means and how it works.

Renewable term life insurance. Renewable term refers to a clause in many term life insurance policies that allow for its renewal without he need for new underwriting. This is called your level of insurability usually youre ability to reapply is limited by a maximum age however.

Unlike whole life insurance term life insurance allows you to determine your current needs and seek coverage accordingly. A popular type of life insurance is renewable term life. What is renewable term life insurance.

When you purchase a term life insurance policy it will last for a specific term length usually from 5 10 15 20 and 30 years. Annual renewable term life insurance lets you lock in a period of insurability which is the length of time youll be able to renew the policy annually without reapplying or taking another. Renewable term life insurance.

At the end of this term period almost every company gives you the option to renew your policy without having to prove proof of insurability. This policy is a temporary form of life insurance that lasts anywhere from 1 30 years and features either level or increasing premiums. How annual renewable term life insurance works.

Most financial advisors will recommend getting a policy that is renewable. Its advantage is that regardless the health status of the policyholder upon the maturity of the policy they can avail themselves of the coverage of the same policy by prolonging its term. A term life insurance policy that allows the policyholder to renew the policy typically at a higher premium rate after the policy has matured.

Annual renewable term insurance art is a form of term life insurance which offers a guarantee of future insurability for a set period of years. Find out why a renewability option is critical in your term life policy.

When Should You Consider Annual Renewable Term Life Insurance

When Should You Consider Annual Renewable Term Life Insurance

Annual Renewable Term Life Insurance Youtube

Annual Renewable Term Life Insurance Youtube

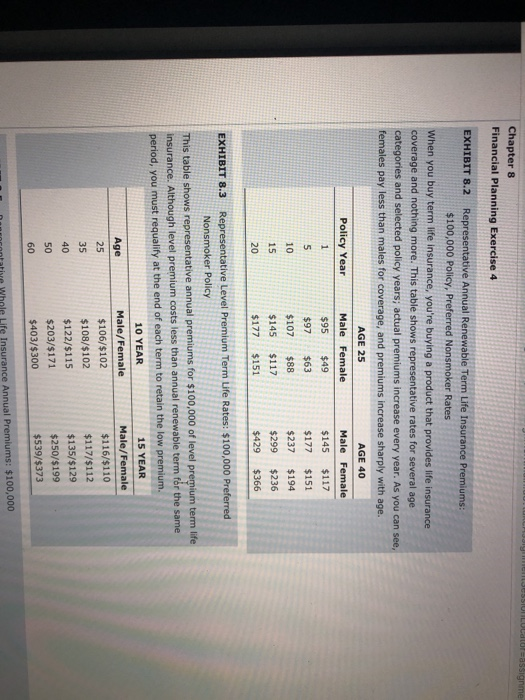

1 Basic Principles Of Life Insurance 1 Pdf Free Download

1 Basic Principles Of Life Insurance 1 Pdf Free Download

Life Insurance King Multipurpose Cooperative

Life Insurance King Multipurpose Cooperative

Flexible Group Life Insurance Sun Life Financial Philippines

Flexible Group Life Insurance Sun Life Financial Philippines

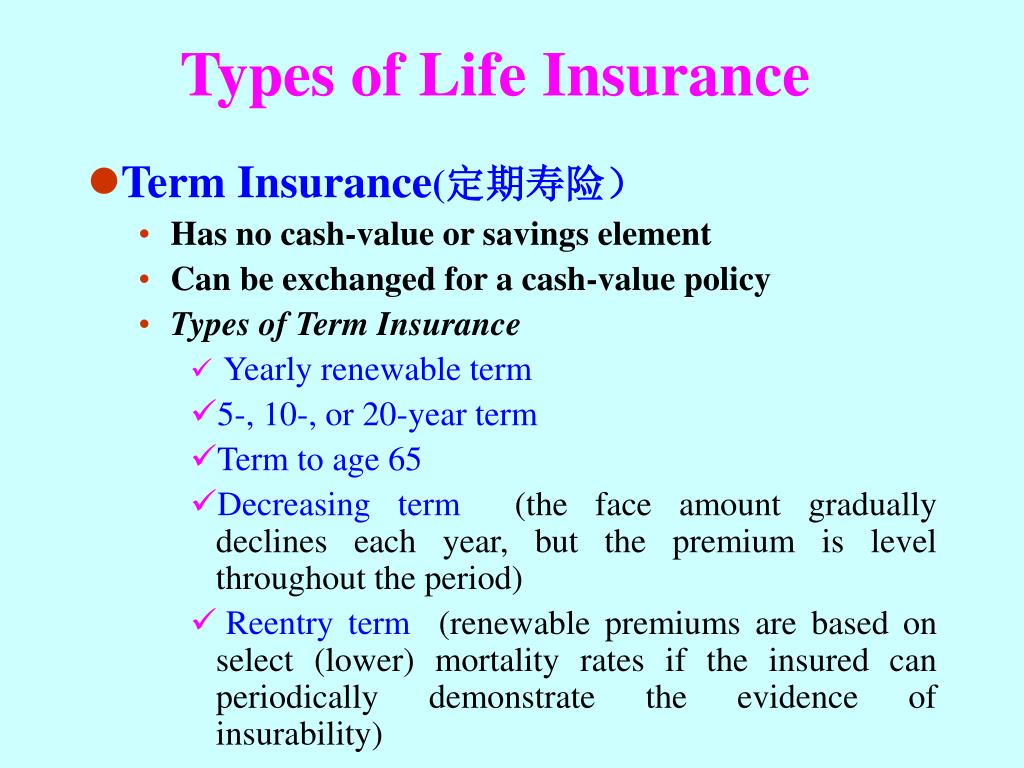

Ppt Lecture Twelve Fundamentals And Types Of Life Insurance

Ppt Lecture Twelve Fundamentals And Types Of Life Insurance

6 Facts About Should I Convert Term Life Insurance To Permanent

6 Facts About Should I Convert Term Life Insurance To Permanent

Convertible Term Life Insurance Is It For Me

Convertible Term Life Insurance Is It For Me

Philippine Top Term Insurance The Benefits Of Getting Insured

Philippine Top Term Insurance The Benefits Of Getting Insured

Convertible Term Life Insurance Affordable Coverage With A Lifeline

Convertible Term Life Insurance Affordable Coverage With A Lifeline

Renewable Term Life Cover Plan Your Life Insurance

Renewable Term Life Cover Plan Your Life Insurance

Https S3 Us West 2 Amazonaws Com Lifebenefits What Is The Best Kind Of Life Insurance Pdf

Learn The Facts About Annual Renewable Term Life Insurance

Learn The Facts About Annual Renewable Term Life Insurance

A 5 Minute Guide To Renewable Term Life Insurance Quotacy

A 5 Minute Guide To Renewable Term Life Insurance Quotacy

What Is Term Life Insurance Daveramsey Com

What Is Term Life Insurance Daveramsey Com

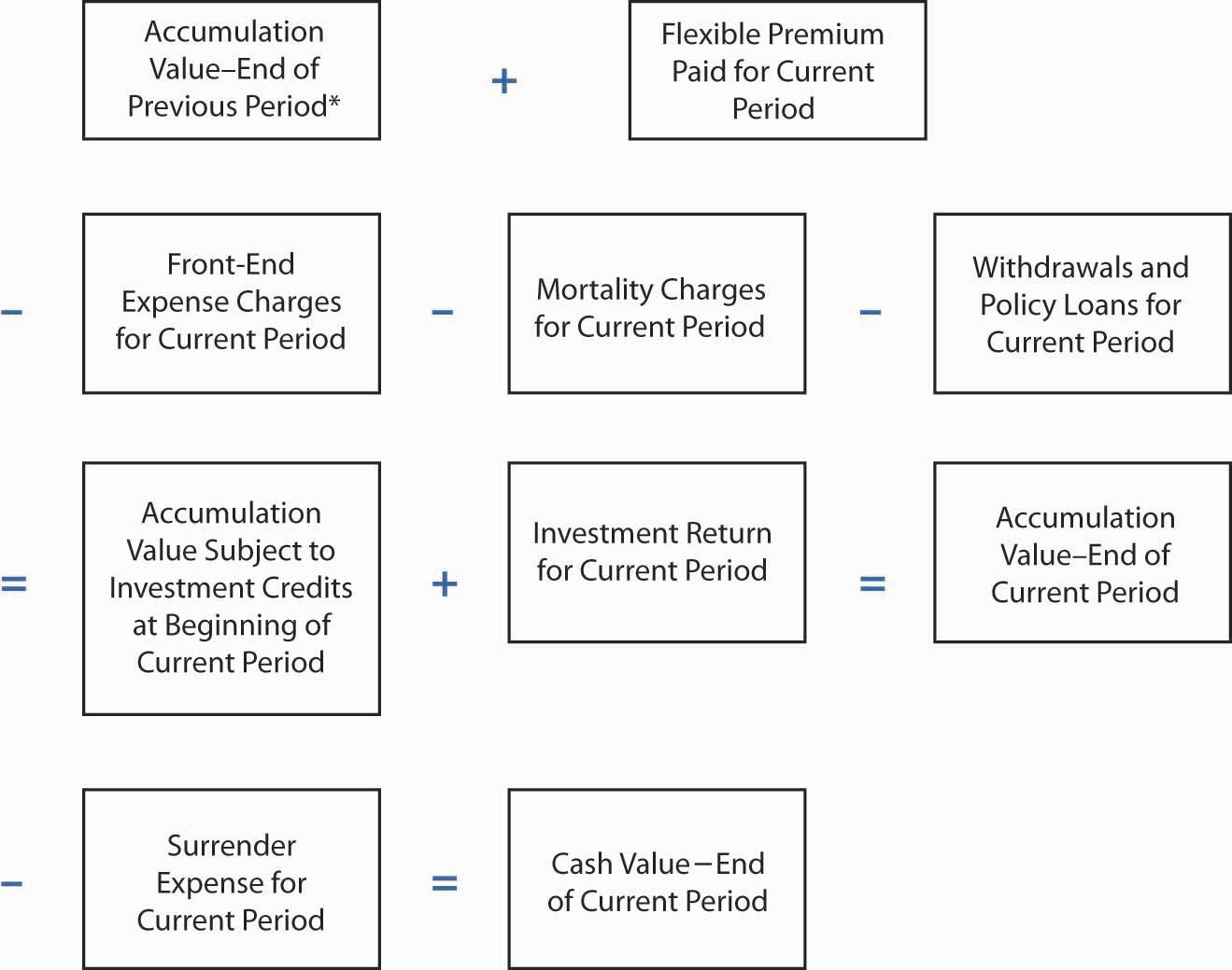

Life Insurance Market Conditions And Life Insurance Products

Life Insurance Market Conditions And Life Insurance Products

5 Types Of Term Life Insurance How Many Types Of Term Life Insurance

5 Types Of Term Life Insurance How Many Types Of Term Life Insurance

Annual Renewal Term Life Insurance Quotes Best Art Plans

Annual Renewal Term Life Insurance Quotes Best Art Plans

Belum ada Komentar untuk "Renewable Term Life Insurance"

Posting Komentar