Taxation Of Life Insurance Benefits

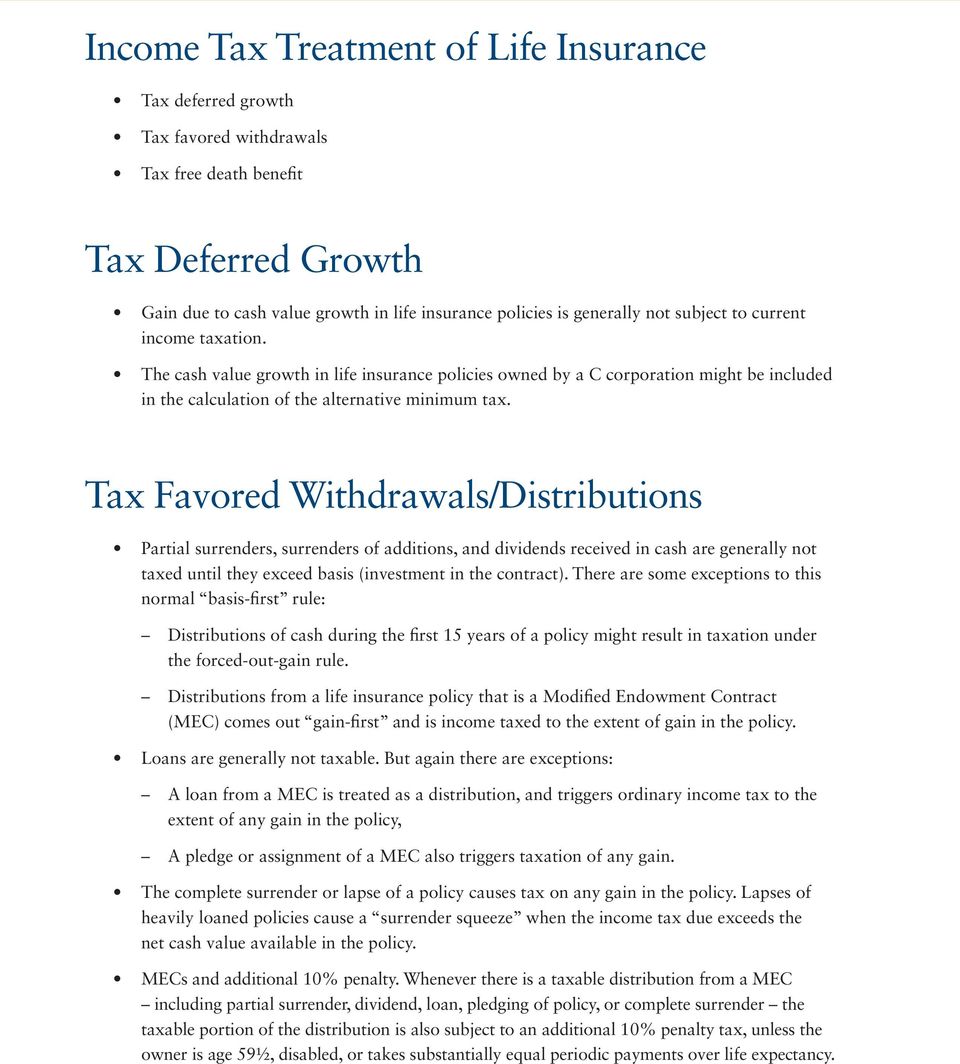

2 income tax free distributions are achieved by withdrawing to the cost basis premiums paid then using policy loans. The premium cost for the first 50000 of life insurance coverage provided under an employer provided group term life insurance plan does not have to be reported as income and is not taxed to you.

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

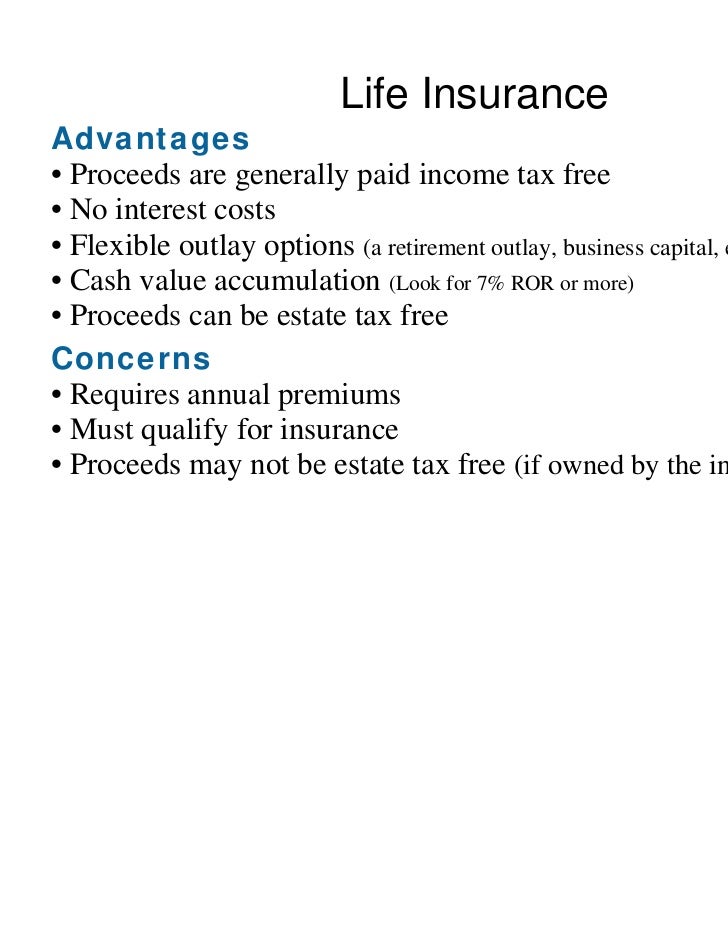

Taxation of life insurance benefits. Estate tax advantages of permanent life insurance. Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. 1 proceeds from an insurance policy are generally income tax free and if properly structured may also be free from estate tax.

Taxation of insurance proceeds received by trustees. Employer paid life insurance may have a tax cost. Loans and withdrawals may generate an income tax liability reduce available cash value and reduce the death benefit or cause the policy to lapse.

Life insurance proceeds are typically not taxable as income but there are several cases in which a life insurance death benefit or policy benefits would be taxed. However any interest you receive is taxable and you should report it as interest received. See topic 403 for more information about interest.

Life insurance proceeds arent taxable most of the time your beneficiaries wont have to pay a tax unless the proceeds become part of your estate and your estate is large enough to be taxable. While most people may look at life insurance proceeds simply as a way to pay off debt or to replace the insureds income there are tax related benefits that can make life insurance policies a. Life insurance is often used to provide liquidity to pay federal estate taxes.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. Learn whether youll have to pay taxes on life insurance. Exemptions apply to ensure that insurance proceeds for cover held on a members behalf through super are not assessable income or an assessable capital gain of a super fund trustee who receives them.

This tax free exclusion also. Term life insurance or permanent life may both be used for this purpose because the focus is the death benefit payable to the heirs.

Taking Advantage Of Your Life Insurance Tax Benefits Gerber Life

Taking Advantage Of Your Life Insurance Tax Benefits Gerber Life

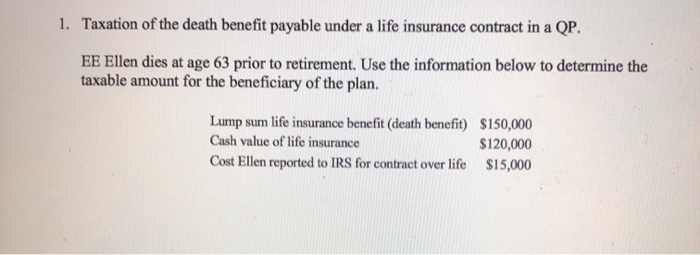

1 Taxation Of The Death Benefit Payable Under A L Chegg Com

1 Taxation Of The Death Benefit Payable Under A L Chegg Com

Income Tax Benefit On Life Insurance Simple Tax India

Income Tax Benefit On Life Insurance Simple Tax India

Things You Should Know About Your Whole Life Insurance Benefits

Things You Should Know About Your Whole Life Insurance Benefits

Life Insurance Beneficiary Life Insurance Tax Benefits

Life Insurance Beneficiary Life Insurance Tax Benefits

Canadian Taxation Of Life Insurance Ninth Edition

Canadian Taxation Of Life Insurance Ninth Edition

Why Should You Buy Term Life Insurance Plan

Why Should You Buy Term Life Insurance Plan

Types Of Death Benefits Generally Excluded From Gross Income Ppt

Types Of Death Benefits Generally Excluded From Gross Income Ppt

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

1 Ins301 Chp15 Part1 Life Insurance And Annuities Terminology

Is Maturity Benefit In Life Insurance Tax Free Comparepolicy

Is Maturity Benefit In Life Insurance Tax Free Comparepolicy

Estate Planning Estate Tax Life Insurance Annuities

Estate Planning Estate Tax Life Insurance Annuities

Income Tax On Life Insurance Benefits And Annuities Finance Zacks

Income Tax On Life Insurance Benefits And Annuities Finance Zacks

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Everything You Must Know About Tax Benefits Of Medical And Life

Everything You Must Know About Tax Benefits Of Medical And Life

1 Guide To Life Insurance Taxes Trusted Choice

1 Guide To Life Insurance Taxes Trusted Choice

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Finding The Best Group Life Insurance Trusted Choice

Finding The Best Group Life Insurance Trusted Choice

Income Tax Benefits Life Insurance Policy And Medical Insurance

Income Tax Benefits Life Insurance Policy And Medical Insurance

Life Insurance Policies Income Tax On Life Insurance Policies

Life Insurance Policies Income Tax On Life Insurance Policies

Read All About Life Insurance Tax Benefits

Read All About Life Insurance Tax Benefits

The Top Cash Value Life Insurance Tax Benefits For You

The Top Cash Value Life Insurance Tax Benefits For You

Belum ada Komentar untuk "Taxation Of Life Insurance Benefits"

Posting Komentar