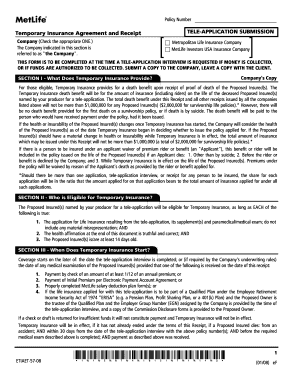

Temporary Insurance Agreement Life Insurance

A tia can provide temporary life insurance coverage while the applicant goes through the life insurance underwriting or evaluation process. Tia stands for temporary insurance agreement.

Do not make checks payable to the agent or leave the payee blank.

Temporary insurance agreement life insurance. Temporary life insurance is less expensive than permanent insurance for the same amount of coverage. If you are considering applying for life insurance you should also consider submitting a premium check along with your application. Premium or authorization for initial eft draft or credit card has been received from in the amount of in payment of one full monthly premium for an insurance policy applied for on the life lives of the above.

I say may because you will still need to qualify for the temporary coverage on a medical and age basis. An insurer and applicant often enter into a temporary insurance agreement tia which provides temporary coverage during this evaluation period. Also called a binding premium receipt or conditional insurance.

Temporary life insurance is coverage you get during the life insurance application process before your actual policy goes into effect. The coverage amount meaning the amount the life insurance carrier will pay out to your beneficiaries if you die may be equal to the amount of coverage youre purchasing for the full policy. Temporary life insurance agreement.

Since these policies can expire insurance companies are less likely to pay out a death benefit so they can afford to charge less. Since underwriting and issuing a life insurance policy takes time temporary insurance may be available. What is a temporary life insurance agreement tia a temporary insurance agreement or tia acts as a binding contract issued by a life insurance agent between a life insurance company and an applicant.

All premium checks must be made payable to the company and sent to the service office address. After you as the applicant sign an application for life insurance the insurer starts determining whether they are willing to insure youduring this process you may be eligible for temporary insurance if. Temporary life insurance agreement this temporary life insurance agreement is hereby entered into as follows.

Most times when you apply for life insurance you have the option of also applying for something commonly known as a tia in the insurance industry. In most instances an application for insurance must undergo an underwriting process to ensure that the applicant meets eligibility requirements. Submitting the first modal premium at the time of application may help you secure temporary coverage while your application is in underwriting.

/GettyImages-958707514-5c326ccac9e77c0001641850.jpg) Understanding How Insurance Premiums Work

Understanding How Insurance Premiums Work

Fillable Online Insurance Arkansas 000 Life Other Product Name

Fillable Online Insurance Arkansas 000 Life Other Product Name

Capital Management For Life Insurers Munich Re

Capital Management For Life Insurers Munich Re

Full Application For Life Insurance Pdf Free Download

Full Application For Life Insurance Pdf Free Download

Life Insurance Application Form California Free Download

Life Insurance Application Form California Free Download

For Financial Professional Use Only Not For Public Distribution

For Financial Professional Use Only Not For Public Distribution

Insurance Domain Knowledge Basics Of Insurance Domain For Testers

Insurance Domain Knowledge Basics Of Insurance Domain For Testers

Insurance Domain Knowledge Basics Of Insurance Domain For Testers

Insurance Domain Knowledge Basics Of Insurance Domain For Testers

:max_bytes(150000):strip_icc()/insurance-endorsement-or-rider-2645729-FINAL-5bdb553b46e0fb00518eef20.png) What Is An Insurance Endorsement

What Is An Insurance Endorsement

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To

Three Of The Most Frequently Asked Questions About Health

Three Of The Most Frequently Asked Questions About Health

The Next Step Successfully Graduating To Life Insurance Advanced

The Next Step Successfully Graduating To Life Insurance Advanced

Life Insurance Application Free Download

Life Insurance Application Free Download

Overview Of Benefits Temporary Faculty Master Agreement Coverage

Overview Of Benefits Temporary Faculty Master Agreement Coverage

For Financial Professional Use Only Not For Public Distribution

For Financial Professional Use Only Not For Public Distribution

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

Buying Life Insurance In A Qualified Plan

Buying Life Insurance In A Qualified Plan

Belum ada Komentar untuk "Temporary Insurance Agreement Life Insurance"

Posting Komentar