Should I Cash In My Whole Life Insurance Policy

Were here to help. I am currently 58 years old and cashed in the traditional insurance policy to help my son buy a house.

Top 10 Best Dividend Paying Whole Life Insurance Companies 2020

Top 10 Best Dividend Paying Whole Life Insurance Companies 2020

The cash value is 2500 and my husband and i want to cash it out and put the money toward paying off debt.

Should i cash in my whole life insurance policy. Cashing in your whole life insurance policy is a big decision that can have lasting consequences on your financial life. This is a far more complicated and vital question to answer. You can do this by notifying your life insurance carrier that you would like to take money out of your policy.

Should i cash in my whole life insurance. My parents took out a traditional whole life insurance policy out in 1976 in my name. What should we do.

So yes a whole life insurance policy can be cashed in. The most direct way to access the cash value in your policy is to make a withdrawal from it. Should i cash in a whole life insurance policy.

If you end up short on cash and are having a difficult time continuing to pay your whole life insurance premium you may be able to stop paying the premium out of pocket and instead use the cash value of your policy to cover the premium. These deposits are held in a cash accumulation account within the policy. A whole life insurance policy grows cash value as you get older and as you pay your premiums.

Cash value life insurance such as whole life and universal life builds reserves through excess premiums plus earnings. No time may be the right time for cracking open your whole life policy for its cash value. If you want your whole life insurance policy will last until.

My mom and dad took out a whole life insurance policy for me when i was born. A whole life insurance policy can provide you with several options. Just because whole life policies can be cashed in does not necessarily mean that they should.

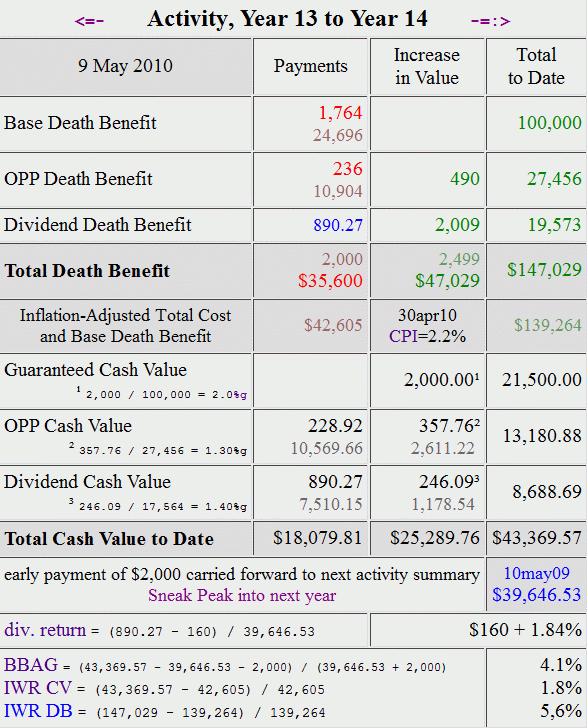

Analysis Of One Participating Whole Life Insurance Policy

Analysis Of One Participating Whole Life Insurance Policy

What Is Term Life Insurance Life Insurance Us News

What Is Term Life Insurance Life Insurance Us News

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Using The Cash Value Of Your Life Insurance Policy The Simple Dollar

Using The Cash Value Of Your Life Insurance Policy The Simple Dollar

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

How Can I Get A Loan From My Life Insurance Policy Globe Life

How Can I Get A Loan From My Life Insurance Policy Globe Life

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

Limited Pay Whole Life Insurance

Limited Pay Whole Life Insurance

Cashing In Your Life Insurance Policy

Cashing In Your Life Insurance Policy

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Whole Life Insurance Life Insurance Pricing Insurance

Whole Life Insurance Life Insurance Pricing Insurance

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

What Does It Mean When A Life Insurance Policy Is Paid Up

What Does It Mean When A Life Insurance Policy Is Paid Up

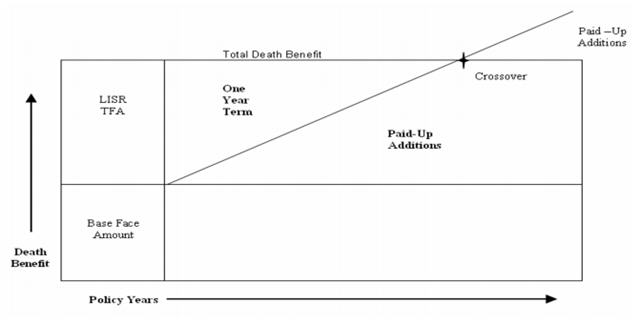

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

Massmutual Whole Life Legacy 10 Pay With Lisr Review

Massmutual Whole Life Legacy 10 Pay With Lisr Review

Belum ada Komentar untuk "Should I Cash In My Whole Life Insurance Policy"

Posting Komentar