Should You Have Life Insurance

But buying a policy doesnt make sense for everyone. Its up to you to work out if this policy is enough to cover your needs and whether or not you need an additional life insurance policy.

Why Should You Buy Term Life Insurance Plan

Why Should You Buy Term Life Insurance Plan

There are a number of ways to save money for your childs education.

Should you have life insurance. In circumstances like the following you may no longer need life insurance. If you have an employee package that includes death in service benefits this will cover you for a multiple of your salary and you might not need additional life insurance. Life insurance sounds like a great thing.

Below youll find questions to ask yourself to help evaluate your life insurance needs. If youre flying through life solo and have no dependents with enough money to cover your debts as. Stay alive and a standard term life insurance plan has zero returnstart a 20 year term policy today and if you dont die by 2032 youll have received nothing.

Have you already got it. You cant pinpoint the ideal amount of life insurance you should buy down to the penny. But you can make a sound estimate if you consider your current financial situation and imagine what your.

You may not have thought that a life insurance policy would be a viable option. The face amount or death benefit of an insurance policy ie the amount of proceeds paid to the beneficiary should be high enough to replace the after tax income you would have earned had you lived a full life presuming you can afford the annual premiums for that amount. The optimal age to purchase life insurance is under 35 but few people in that age group are able to afford life insurance.

People who have no minor children or financially strapped dependents might not need life insurance. Roughly 57 of americans have life insurance and more than half of them. But insurance payouts can actually provide a good supplement your savings.

If you have life insurance through your work you should still buy your own life insurance policy. First when you and your spouse have accumulated enough assets and income streams to independently care for yourselves. How much coverage should i buy.

If you decide to purchase insurance you should know exactly why you are buying it and choose the best type of policy for your needs. Life insurance allows those you leave behind to take care of any lingering financial responsibilities. The reason you should never only rely on life insurance at work is that you could lose your job or decide to change jobs and once you do that you lose that life insurance policy.

Search Q Types Of Insurance Tbm Isch

Video 7 Reasons Why You Should Buy Life Insurance Accuquote

Video 7 Reasons Why You Should Buy Life Insurance Accuquote

Keeping You And Your Family Safe Life Insurance 101 Williamson

Keeping You And Your Family Safe Life Insurance 101 Williamson

6 Reasons You Should Get Life Insurance Today

6 Reasons You Should Get Life Insurance Today

Life Insurance A Cheat Sheet On The Basics Life Insurance Agent

Life Insurance A Cheat Sheet On The Basics Life Insurance Agent

How Much Life Insurance Should You Have Medical Economics

How Much Life Insurance Should You Have Medical Economics

This Is For Your Newborn Baby Should You Get Whole Life Or Term Life

This Is For Your Newborn Baby Should You Get Whole Life Or Term Life

Buying Insurance Tick These Life Health Cover Boxes First

Buying Insurance Tick These Life Health Cover Boxes First

7 Reasons Parents Should Have Life Insurance Teensgotcents

7 Reasons Parents Should Have Life Insurance Teensgotcents

How Much Life Insurance Do I Need Murphy Insurance Ma

How Much Life Insurance Do I Need Murphy Insurance Ma

How Much Life Insurance Coverage Should You Buy

How Much Life Insurance Coverage Should You Buy

Max Life Term Insurance Plan That Returns Premium Provides Cover

Max Life Term Insurance Plan That Returns Premium Provides Cover

Chapter 10 Financial Planning With Life Insurance Ppt Video

Chapter 10 Financial Planning With Life Insurance Ppt Video

Should I Buy Term Or Whole Life Insurance

Should I Buy Term Or Whole Life Insurance

Life Insurance And Divorce What You Should Know

Life Insurance And Divorce What You Should Know

6 Reasons Why You Should Buy Life Insurance

6 Reasons Why You Should Buy Life Insurance

When You Should Review Your Life Insurance Cover

When You Should Review Your Life Insurance Cover

Investments You Need Before 50 Bancassurance Bpi Philam

Investments You Need Before 50 Bancassurance Bpi Philam

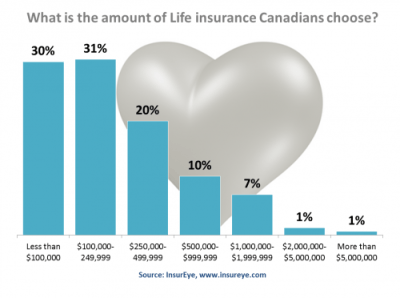

4 Things You Should Know About Life Insurance In Canada

4 Things You Should Know About Life Insurance In Canada

Everyone Should Have Life Insurance Take A Look At These 5

Everyone Should Have Life Insurance Take A Look At These 5

Belum ada Komentar untuk "Should You Have Life Insurance"

Posting Komentar