Term Life Insurance Whole Life Insurance

The high premium is the only concern of customers when buying whole life insurance. Affordable term life insurance that automatically covers all singapore citizens and permanent resident cpf members who are aged 21 to 60 years old.

Term Life Vs Whole Life Stock Illustration Illustration Of

Term Life Vs Whole Life Stock Illustration Illustration Of

The benefits of whole life insurance.

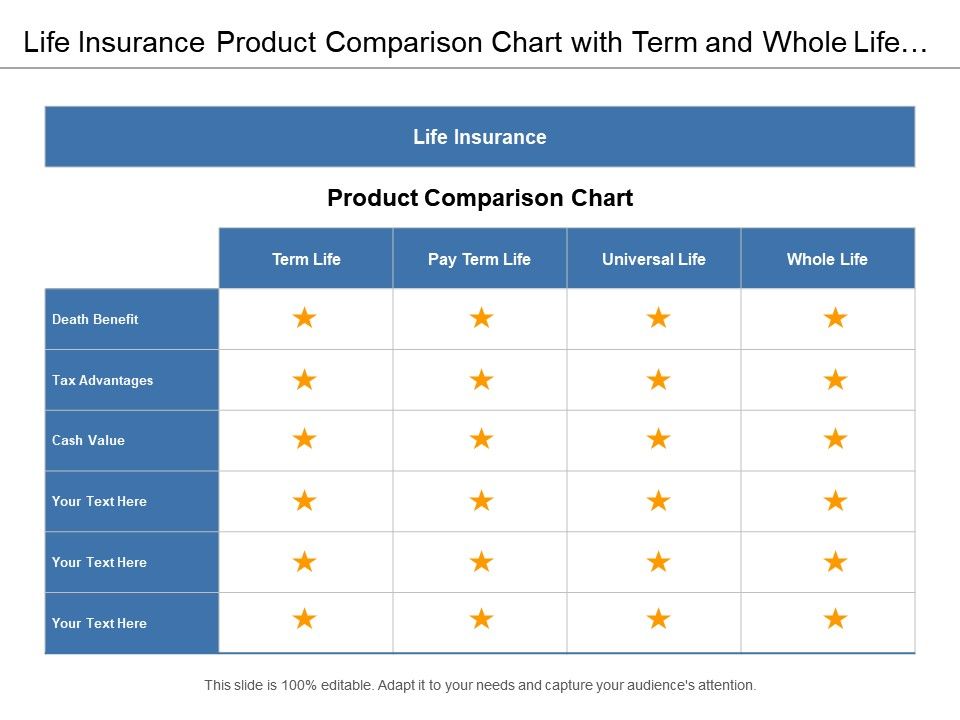

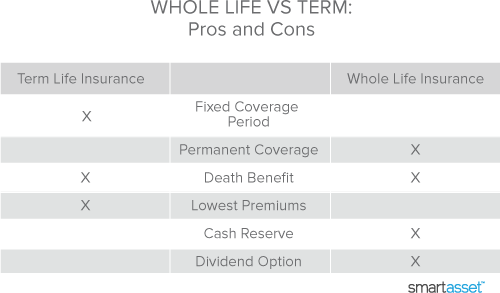

Term life insurance whole life insurance. But most people can start shopping by making one key decision. Term insurance plans and whole life insurance plans are two different products which caters to different needs of their customers. Term life policies have no value other than the guaranteed death benefit.

Both types have their benefits and drawbacks. Term life insurance is affordable and straightforward while whole life doesnt expire but is more expensive. Buying life insurance seems daunting.

Whole life insurance costs more because it lasts a lifetime and does have cash value. You must choose any one of these products based on your financial requirements and future goals. Term insurance vs whole life insurance.

Such individuals have more liabilities in the form of spouse and children so there is need for both financial security and life protection. Whole life insurance provides a death benefit throughout your life. Now that you know the differences between term life insurance and whole life insurance you can make an informed choice to find the best life insurance solution for you and your family.

At the end of the term you receive no return on the money that you paid for the insurance but if you die before the term is over then your loved ones will receive the full amount of the policy. Term life insurance is purchased for a specific period of time usually from one to twenty years. A whole life policy covers the rest of your life not just a stated term.

The policys purpose is to give insurance to. Find out more by contacting an insurance agent in your area. There is no savings component as found in a whole life insurance product.

Do you need term life insurance or whole life insurance. Individuals above 40 years of age are advised to purchase whole life insurance. Life insurance products for groups.

In 2003 about 64 million individual life insurance policies bought were term and about 71 million were whole life. Compare cost and policy features. It also includes a cash value component that accrues value over time allowing you to borrow or withdraw funds as needed.

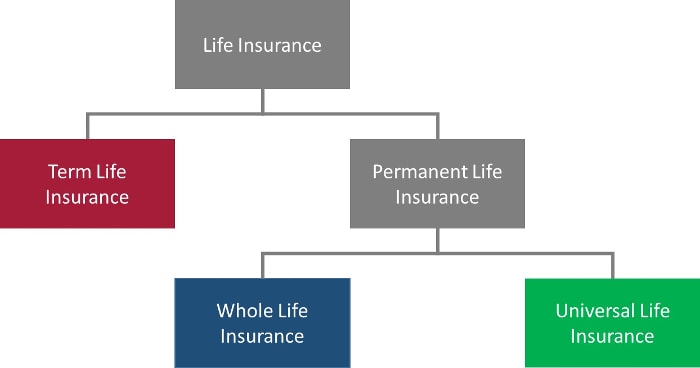

Term life insurance is cheap because its temporary and has no cash value. Whole life is sometimes called permanent life insurance and it encompasses several subcategories including traditional whole life universal life variable life and variable universal life.

Life Insurance Product Comparison Chart With Term And Whole Life

Life Insurance Product Comparison Chart With Term And Whole Life

Pros And Cons Of Whole Life Vs Term Life Insurance The Schwab

Pros And Cons Of Whole Life Vs Term Life Insurance The Schwab

Difference Between Term And Whole Life Insurance Whole Life

Difference Between Term And Whole Life Insurance Whole Life

Term Vs Whole Life Insurance Which Is Better

Term Vs Whole Life Insurance Which Is Better

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

Term Life Or Whole Life Which Insurance Is Best For You

Term Life Or Whole Life Which Insurance Is Best For You

Term Life Insurance Definition

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

How Cash Value Life Insurance Works

How Cash Value Life Insurance Works

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Working Adult Guide Term Life Or Whole Life Insurance Which

Working Adult Guide Term Life Or Whole Life Insurance Which

Term Life Insurance Vs Whole Life Insurance

Term Life Insurance Vs Whole Life Insurance

Insurance Atsa Industries United States

Insurance Atsa Industries United States

Term Life Vs Whole Life Insurance Why Talking With The Right

Term Life Vs Whole Life Insurance Why Talking With The Right

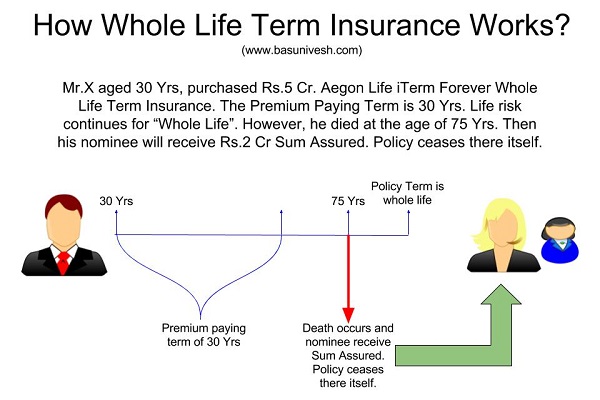

Aegon Life Iterm Forever Whole Life Term Insurance Should You

Aegon Life Iterm Forever Whole Life Term Insurance Should You

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Insurance V S Whole Life Insurance Video Policygenius

Term Life Insurance V S Whole Life Insurance Video Policygenius

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Term Life Insurance Vs Whole Life Insurance Johnson

Term Life Insurance Vs Whole Life Insurance Johnson

Different Types Of Life Insurance Life Insurance Policy Types

Different Types Of Life Insurance Life Insurance Policy Types

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Belum ada Komentar untuk "Term Life Insurance Whole Life Insurance"

Posting Komentar