Term V Whole Life Insurance

In the simplest of terms its not worth anything unless one of you were to die during the course of the term. Here are some of the main features of term and whole life insurance.

What Is Term Life Insurance Life Insurance Us News

What Is Term Life Insurance Life Insurance Us News

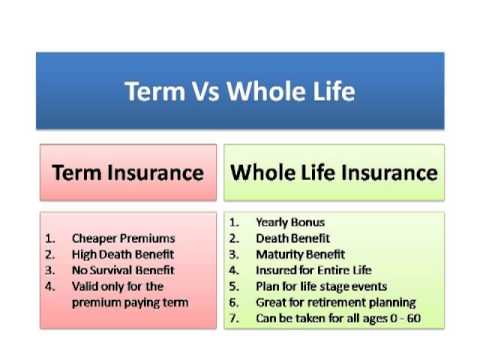

Features of term life insurance.

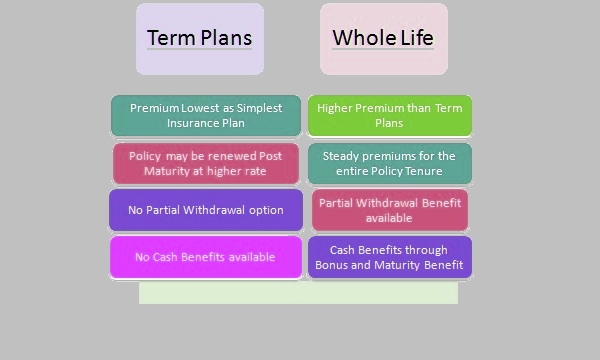

Term v whole life insurance. Term v whole life insurance if you are looking for the best insurance quotes then our free online service will give you the information you need in no time. The high premium is the only concern of customers when buying whole life insurance. Provides death benefits only.

Term life and whole life are two popular variations of life insurance policies. Whole life insurance is good for people who want their beneficiaries to receive a payout no matter when they pass away. Whole life insurance costs more because it lasts a lifetime and does have cash value.

Term life insurance is good for people who want insurance for specific financial obligations with a known end. Pays benefits only if you die while the term of the policy is in effect. Individuals above 40 years of age are advised to purchase whole life insurance.

Term v whole life insurance if you are looking for the best deals on insurance then our insurance quotes service can provide you with a wide range of options. This is because the term life policy has no cash value until you or your spouse passes away. Term insurance vs whole life insurance.

Term life insurance plans are much more affordable than whole life insurance. It has no cash value. No matter what type of insurance you choose here are some basic definitions you need to.

While essentially providing benefits in case of the insureds policyholder demise during policy tenure these plans vary in a lot of ways. Purchased for a specific time period such as 5 10 15 or 30 years known as a term. Term life insurance is cheap because its temporary and has no cash value.

Easiest and most affordable life insurance to buy. There are differences between term and whole life insurance but some concepts are the same across types. Common term whole life insurance definitions.

Compare cost and policy features. If you are planning to buy a life insurance policy you have probably heard of both term insurance plans and whole life insurance plans. While the basic idea of providing much needed cash in the event of your death is the same there are some big.

Whole life insurance premiums are level they stay the same no matter how long you have the policy. Such individuals have more liabilities in the form of spouse and children so there is need for both financial security and life protection.

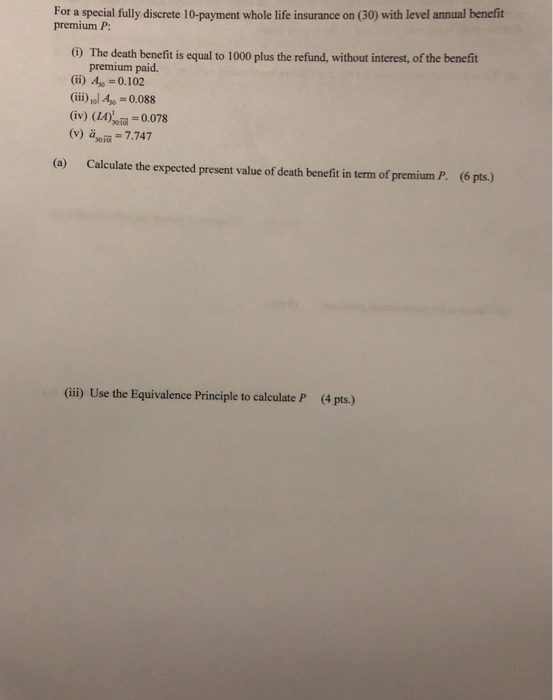

Solved For A Special Fully Discrete 10 Payment Whole Life

Solved For A Special Fully Discrete 10 Payment Whole Life

Dependants Protection Scheme Dps All You Need To Know About

Dependants Protection Scheme Dps All You Need To Know About

Varying Benefit Insurance Issued Life Contingencies Lecture

Varying Benefit Insurance Issued Life Contingencies Lecture

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

Term Vs Whole Life Insurance Which Is Best For You The Motley

Term Vs Whole Life Insurance Which Is Best For You The Motley

Wholelifeinsurance Instagram Photo And Video On Instagram

Wholelifeinsurance Instagram Photo And Video On Instagram

How Will A Whole Life Insurance Policy Work Edocr

How Will A Whole Life Insurance Policy Work Edocr

Wholelife Instagram Posts Photos And Videos Picuki Com

Wholelife Instagram Posts Photos And Videos Picuki Com

Types Of Life Insurance Chart Parta Innovations2019 Org

Types Of Life Insurance Chart Parta Innovations2019 Org

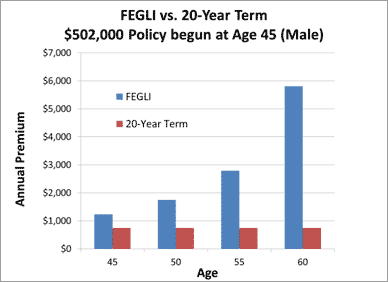

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

Term Vs Permanent Life Insurance What You Need To Know

Term Vs Permanent Life Insurance What You Need To Know

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Term Insurance Vs Whole Life Insurance Youtube

Term Insurance Vs Whole Life Insurance Youtube

Life Insurance The Good The Bad And The Fegli Fedsmith Com

Life Insurance The Good The Bad And The Fegli Fedsmith Com

What Are Life Insurance Table Ratings We Explain How They Work

What Are Life Insurance Table Ratings We Explain How They Work

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Belum ada Komentar untuk "Term V Whole Life Insurance"

Posting Komentar